Category: General Firm Info

3 posts categorized as "General Firm Info"

19Apr

Astor Strategies/U.S. Economy Update: April 2024

The Astor Monthly Economic Update is changing formats slightly this month. We are keeping the astute economic commentary you’ve come to rely on, but in a more concise format and with clearer ties to the portfolios we manage. ASTOR DYNAMIC ALLOCATION: AVERAGE AND STABLE EQUITY ALLOCATION The U.S. economy showed no signs of cooling further,…

6Dec

Employee of the Year for 2022 – Stephanie Yuskis

Astor Investment Management is pleased to announce that Stephanie Yuskis, Chief of Staff, has been awarded the Employee of the Year for 2022. Your contributions to making Astor what it is today are sincerely appreciated. Thank you for all your hard work – day in and day out. We are sure lucky to have you…

2Dec

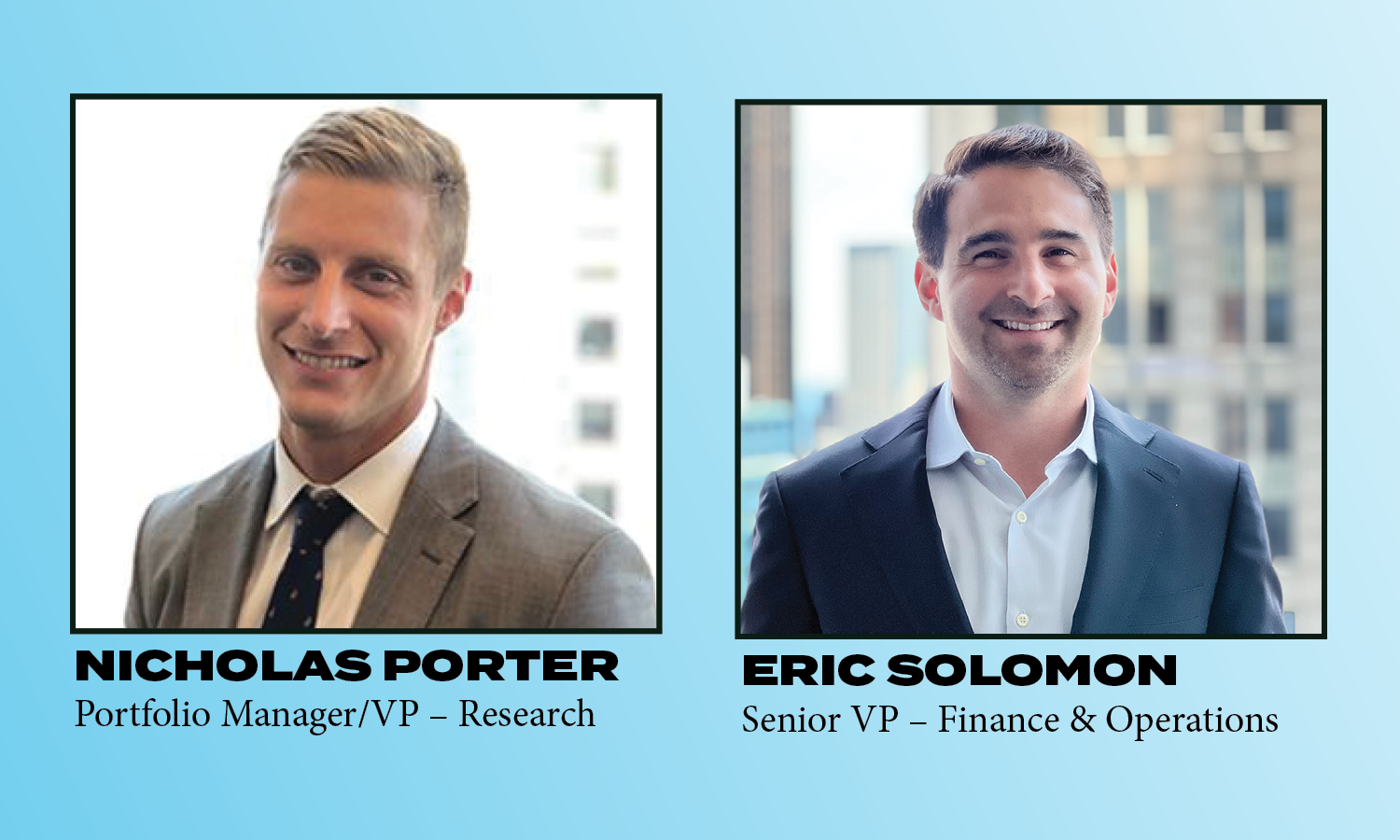

Congratulations Nicholas Porter and Eric Solomon

Astor Investment Management is pleased to announce key personnel promotions. Nicholas Porter has been promoted to the position of Portfolio Manager/VP – Research and Eric Solomon has been promoted to the position of Senior VP – Finance & Operations effective immediately. Please help us in congratulating them both on this wonderful achievement.