Category: News/ Press Releases

10 posts categorized as "News/ Press Releases"

8May

A Nuanced Macroeconomic Approach to Investing: An interview with Bryan Novak, Astor IM CEO.

When the economy and markets are clearly surging, defensive investment strategies may not be popular but when we are in the inevitable cyclical or disruptive periods of uncertainty or at inflection points of change, it may be prudent to diversify into more risk managed strategies that focus on the macroeconomic forces that drive the everchanging…

8Jan

Job Market Insights: Analyzing the Latest Numers and Their Impact on the Federal Reserve

Astor’s CIO John Eckstein and Nick Tell, CEO of Armory Capital discuss the the latest economic numbers and their impact on the federal reserve. LISTEN NOW! MAS-M-476982-2024-01-08

14Dec

Let’s Look at Labor, Employment, and Payroll Trends

Astor’s CIO John Eckstein and Nick Tell, CEO of Armory Capital discuss the Labor Market and Payroll Trends. LISTEN NOW! MAS-M-467041-2023-12-08

9Oct

Get the Breakdown of the Latest Payroll Number with CEO Rob Stein and CIO John Eckstein

CIO John Eckstein and CEO Rob Stein discuss the current state of the economy, which they coin as ‘Goldilocks.’ In this episode 130, they delve into key economic indicators such as the employment situation report, inflation, an economy review, and payroll numbers. Tune in now! MAS-M-434759-2023-10-09

6Dec

Employee of the Year for 2022 – Stephanie Yuskis

Astor Investment Management is pleased to announce that Stephanie Yuskis, Chief of Staff, has been awarded the Employee of the Year for 2022. Your contributions to making Astor what it is today are sincerely appreciated. Thank you for all your hard work – day in and day out. We are sure lucky to have you…

2Dec

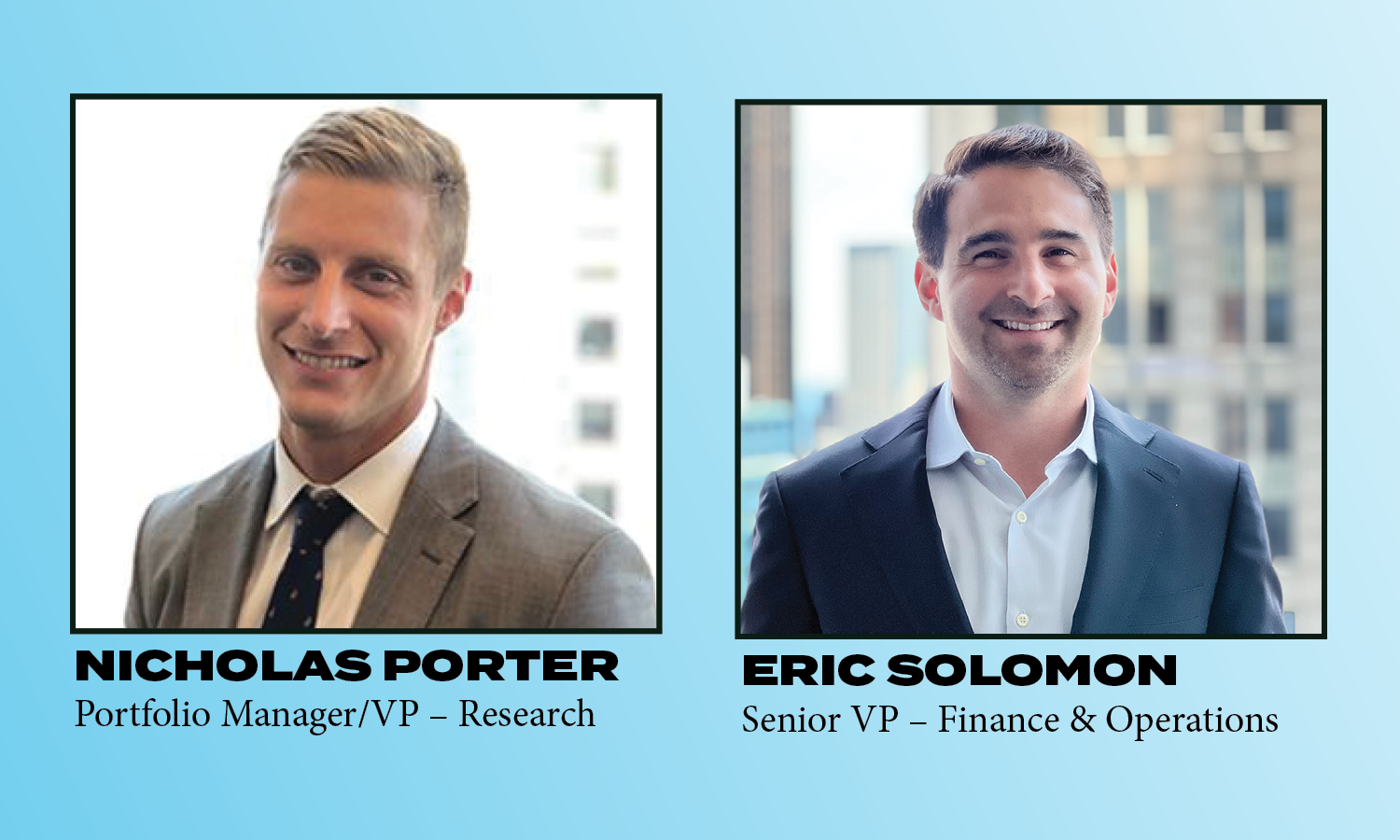

Congratulations Nicholas Porter and Eric Solomon

Astor Investment Management is pleased to announce key personnel promotions. Nicholas Porter has been promoted to the position of Portfolio Manager/VP – Research and Eric Solomon has been promoted to the position of Senior VP – Finance & Operations effective immediately. Please help us in congratulating them both on this wonderful achievement.

15Aug

Latest inflation news and the outlook for the Fed

Astor’s CIO, John Eckstein, and research associate, Nick Porter, deep dive into the latest inflation news and the outlook for the Fed.

8Aug

What does the latest payroll report tell us about inflation and the fed?

Astor’s CEO, Rob Stein, and CIO, John Eckstein, discuss the latest payroll report and what it tells us about inflation and the fed.

8Jul

You Can’t Buy Love and You Can’t Buy An Expansion

As the markets hit that magical percent drawdown number, market experts tell us we are in a bear market. If only they told us sooner… Inflation was not transitory after all, and the Fed needed to react which led to the typical result from raising rates quickly… Again, who could predict that mailing money to…

12May

Market Commentary: It’s all about the Fed… Still

The markets have had a challenging time the past few weeks, quickly retracing back to the levels of a year ago. Perspective is always important, but the Fed’s perspective is essential! As I said at the beginning of the year, it’s all about the Fed and how they navigate interest rates. The Fed got it wrong when…