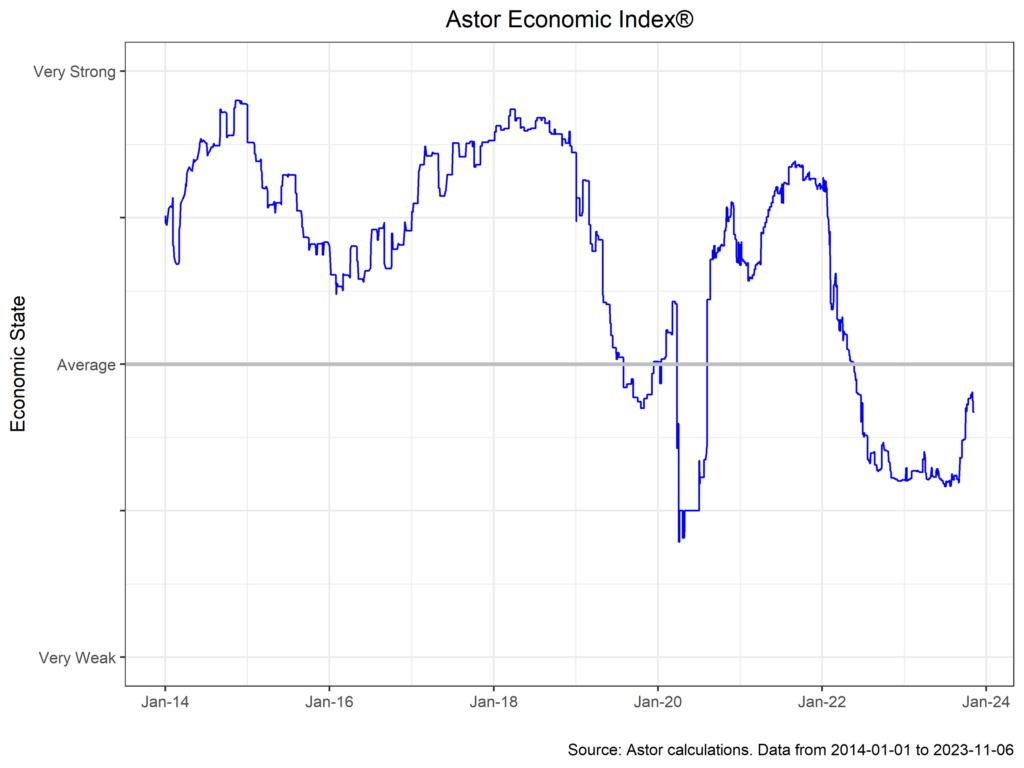

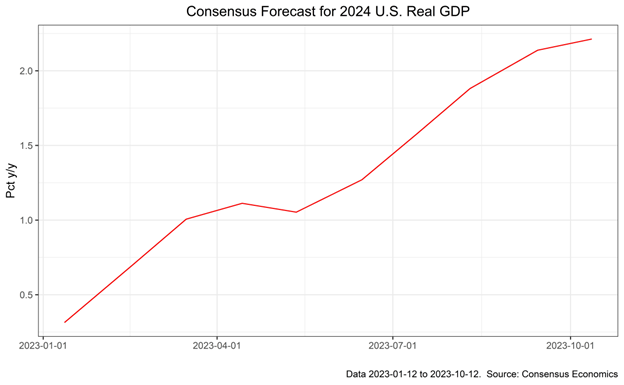

The Astor Economic Index® (AEI) continued its upward trend in October, ending at a level just around average economic growth. It has been an interesting journey for the AEI this year so far, with somewhat weak growth (driven mostly by soft PMIs) balanced out by a very hot labor market. Due in part to soft survey-based data, economic commentators had been predicting an imminent recession in 2023 for some time. Today, however, forecasts for 2024 have picked up, even as the labor market has cooled towards its long-term average.

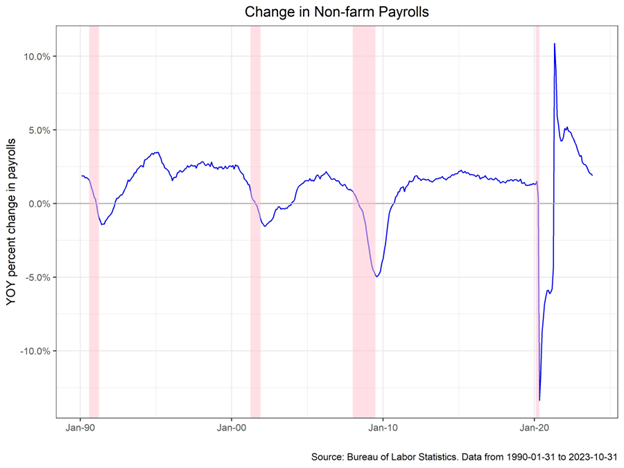

Non-farm payrolls printed 150,000 at for October, which is somewhere in the ballpark of the breakeven rate. Prior months were revised downwards, and U3 unemployment ticked up to 3.9%. Average hourly earnings, an important link to inflation, cooled further to 0.2% m/m. This will all be encouraging news to the Federal Reserve, which has pointed to the necessity of a softening in labor conditions to meet its 2% inflation objective. The unanswered question is if this month’s number marks a healthy trend towards a belated normalization of the economy or puts us on the path towards economic contraction and job losses.

Economic forecasts, for their part, see 2024 growth as stronger today than they did a few months ago, with the average real GDP forecast just shy of 1% y/y among economists polled by Consensus Economics. Some of this is due to recent trends: Q3 GDP printed at 4.9% (Q/Q SAAR). As always, the consumer drove domestic output (4% SAAR), with nonresidential investment dragging. A build in inventories was also to thank – excluding restocking, exports and imports, final sales to domestic purchasers were up a healthy 3.5%.

It seems likely that these next few months will prove crucial to understanding the direction of the economy over the next twelve months. Two scenarios are plausible: in the first, the Fed has done just enough to cool the economy and the economy grows modestly, with durably higher long-term rates, slightly above target inflation and a labor market consistent with equilibrium. In the second, the Fed has done too much or too little and is forced to react. As unbelievable as it may have seemed a short few months ago, it seems more probable that the Fed has achieved a soft landing but risks certainly remain that inflation picks up and rates rise further, crushing the economy, or that rates have started to bite more than we think, and the economy spirals into a recession. We will be watching higher frequency measures of the labor market and output (JOLTs, for example) to better understand this balance in coming weeks.

Astor Investment Management LLC is a registered investment adviser with the SEC. All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. They are not intended as investment recommendations. These materials contain general information and have not been tailored for any specific recipient. There is no assurance that Astor’s investment programs will produce profitable returns or that any account will have similar results. You may lose money. Past results are no guarantee of future results. Please refer to Astor’s Form ADV Part 2A Brochure for additional information regarding fees, risks, and services.

The Astor Economic Index®: The Astor Economic Index® is a proprietary index created by Astor Investment Management LLC. It represents an aggregation of various economic data points. The Astor Economic Index® is designed to track the varying levels of growth within the U.S. economy by analyzing current trends against historical data. The Astor Economic Index® is not an investable product. The Astor Economic Index® should not be used as the sole determining factor for your investment decisions. The Index is based on retroactive data points and may be subject to hindsight bias. There is no guarantee the Index will produce the same results in the future. All conclusions are those of Astor and are subject to change. Astor Economic Index® is a registered trademark of Astor Investment Management LLC.

MAS-M-454056-2023-11-08