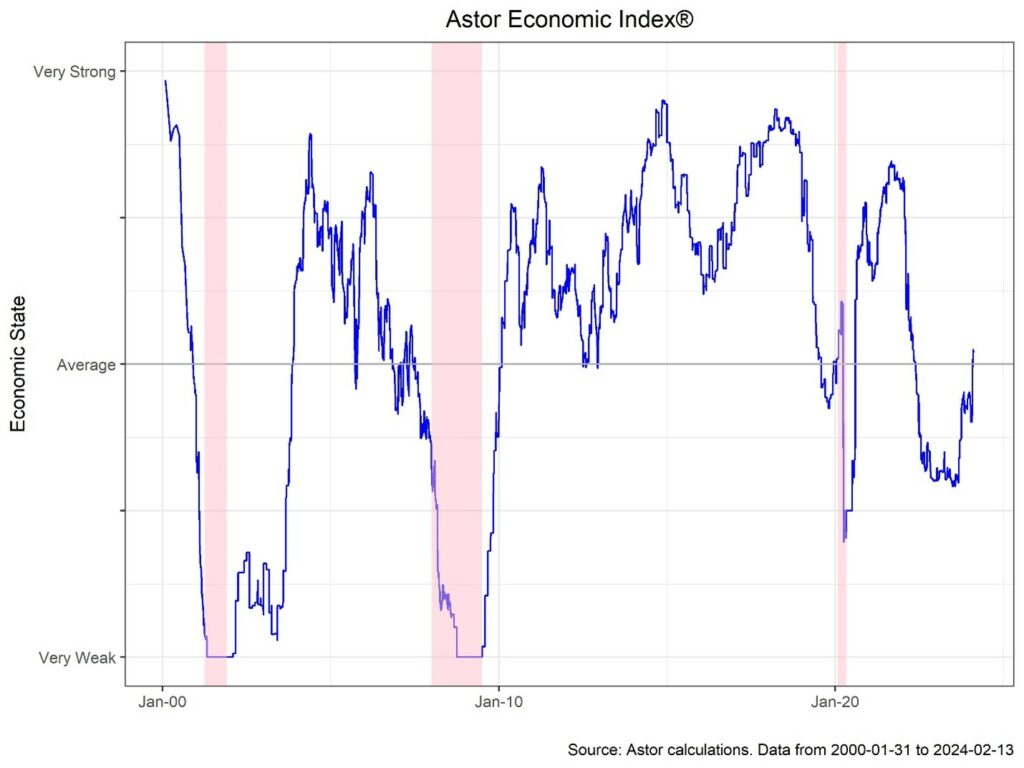

The U.S. economy has defied predictions of its imminent demise for some time, and data from the month of January reinforced that trend with robust labor figures and hotter inflation numbers. Markets have been forced to reprice their expectations for a quick March cut by the Fed, with Chair Powell strongly pushing back against the idea of early easing. The Astor Economic Index® (AEI) has strengthened accordingly to slightly above average growth, having begun the year below average.

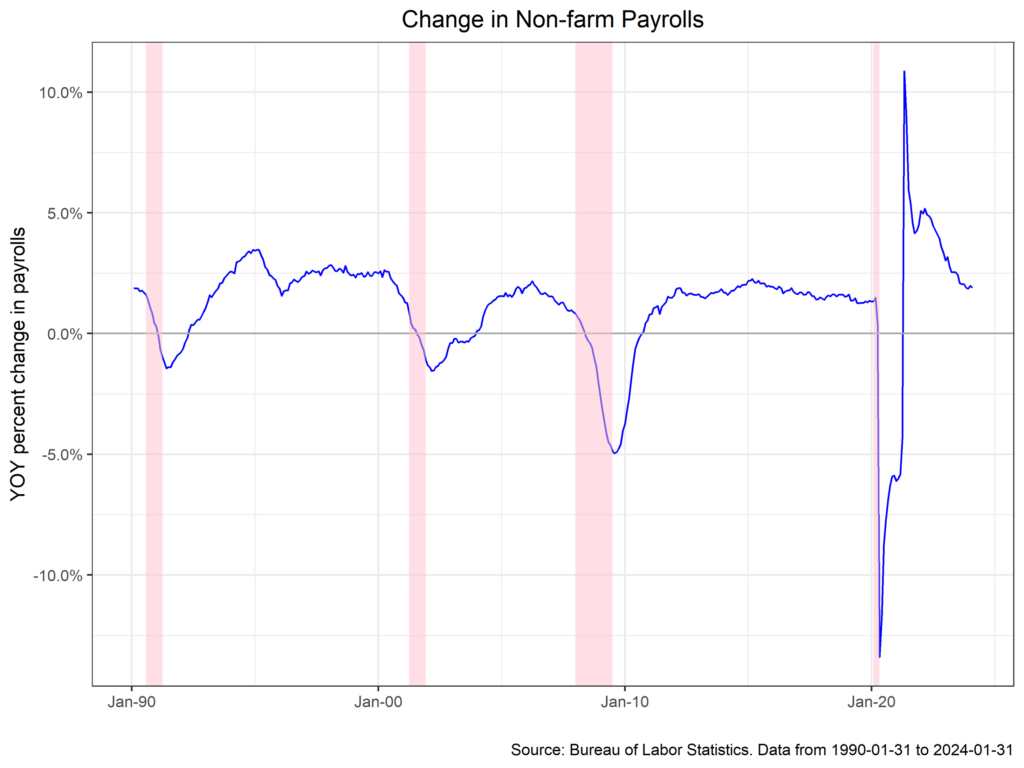

The ongoing expansion of the labor market is much to thank for improvements in the AEI. January payrolls came in at a strong 353,000 jobs added, well above survey expectations of 185,000 and the highest figure since January of last year. The number is somewhat ameliorated by the difficulty of seasonal adjustments following the holiday season, but should not be handwaved away, with other series, like initial jobless claims, near secular lows (218,000 most recently). Nonetheless, if you squint, you can find series that point to broader weaknesses – job quits, which fall during looser labor markets, are below their pre-pandemic levels, and average weekly hours worked have plummeted to below 2019 readings. The household survey, which measures employment by asking households their employment situation, is pointing the opposite way from the payroll survey.

What should we do in the face of contrasting labor data? Particularly in the wake of pandemic era distortions, all data should be viewed with a jaundiced eye, and aggregation (like the AEI) grows in importance. We tend to follow two practical points. First, the truth is probably somewhere in between, with labor growth not quite as hot as non-farm payrolls would have you believe, but nowhere as bad as the other data discussed seems to depict. Second, consider overweighing data that follows the narrative from other sectors of the economy (i.e., not the labor market).

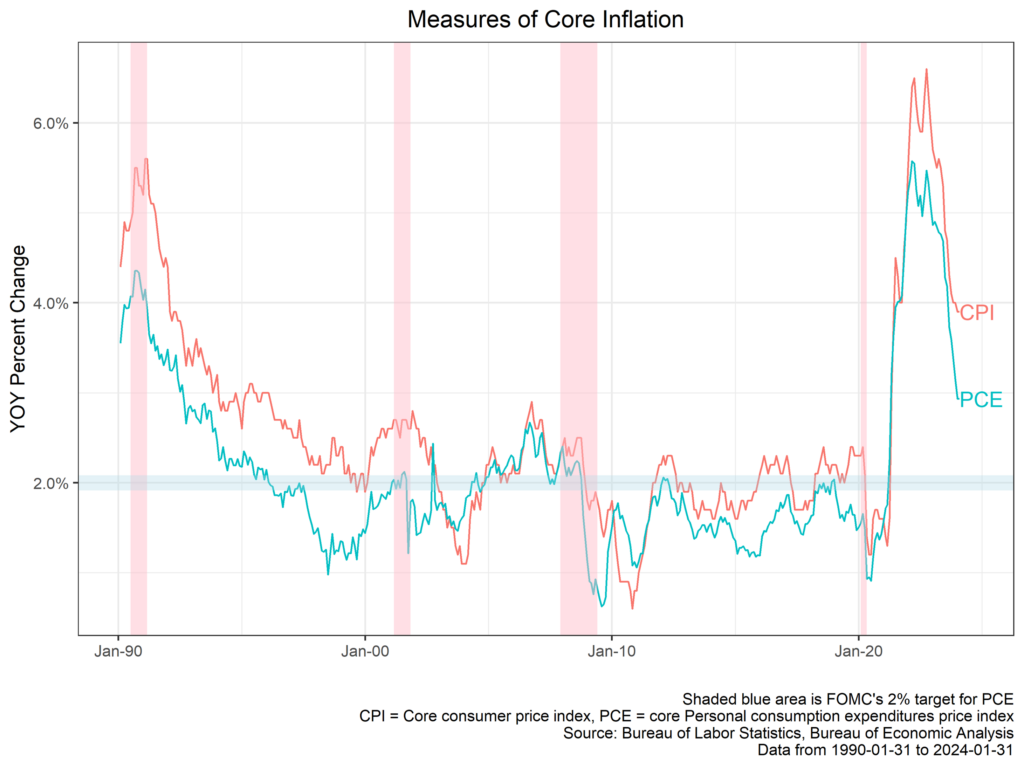

Inflation data is such a series. CPI for January was up 0.3% m/m (3.1% y/y), or 0.4% core (3.9% y/y), disappointing to the upside. Headline inflation was once again led by core services, which contributed 3.1 percentage points, and in turn was once again comprised mostly of shelter and transportation. So called supercore inflation, a narrower measure of what the Fed considers important, was up 0.85% m/m, the hottest since 2022.

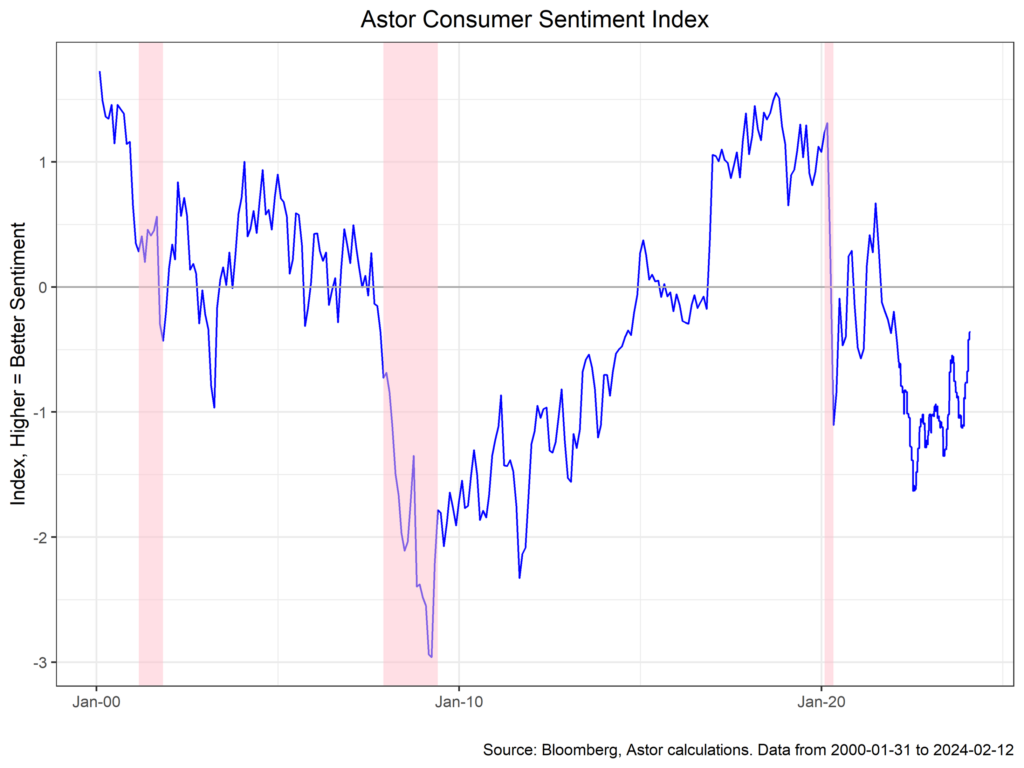

The data were just further pushback against the market’s long held notion of cuts by the Fed in March. Chair Powell came out strongly against the possibility of action by the Fed in his recent press conference, and it now looks like the Fed may be on hold until at least June of this year. The Fed’s case is bolstered beyond labor and inflation data – consumer sentiment has recovered recently, and purchaser manager indices are once again rising. At Astor, we will consider the breadth of the data in its totality and allocate accordingly.

Astor Investment Management LLC is a registered investment adviser with the SEC. All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. They are not intended as investment recommendations. These materials contain general information and have not been tailored for any specific recipient. There is no assurance that Astor’s investment programs will produce profitable returns or that any account will have similar results. You may lose money. Past results are no guarantee of future results. Please refer to Astor’s Form ADV Part 2A Brochure for additional information regarding fees, risks, and services.

The Astor Economic Index®: The Astor Economic Index® is a proprietary index created by Astor Investment Management LLC. It represents an aggregation of various economic data points. The Astor Economic Index® is designed to track the varying levels of growth within the U.S. economy by analyzing current trends against historical data. The Astor Economic Index® is not an investable product. The Astor Economic Index® should not be used as the sole determining factor for your investment decisions. The Index is based on retroactive data points and may be subject to hindsight bias. There is no guarantee the Index will produce the same results in the future. All conclusions are those of Astor and are subject to change. Astor Economic Index® is a registered trademark of Astor Investment Management LLC.

MAS-M-499907-2024-02-14