The Astor Monthly Economic Update is changing formats slightly this month. We are keeping the astute economic commentary you’ve come to rely on, but in a more concise format and with clearer ties to the portfolios we manage.

ASTOR DYNAMIC ALLOCATION: AVERAGE AND STABLE EQUITY ALLOCATION

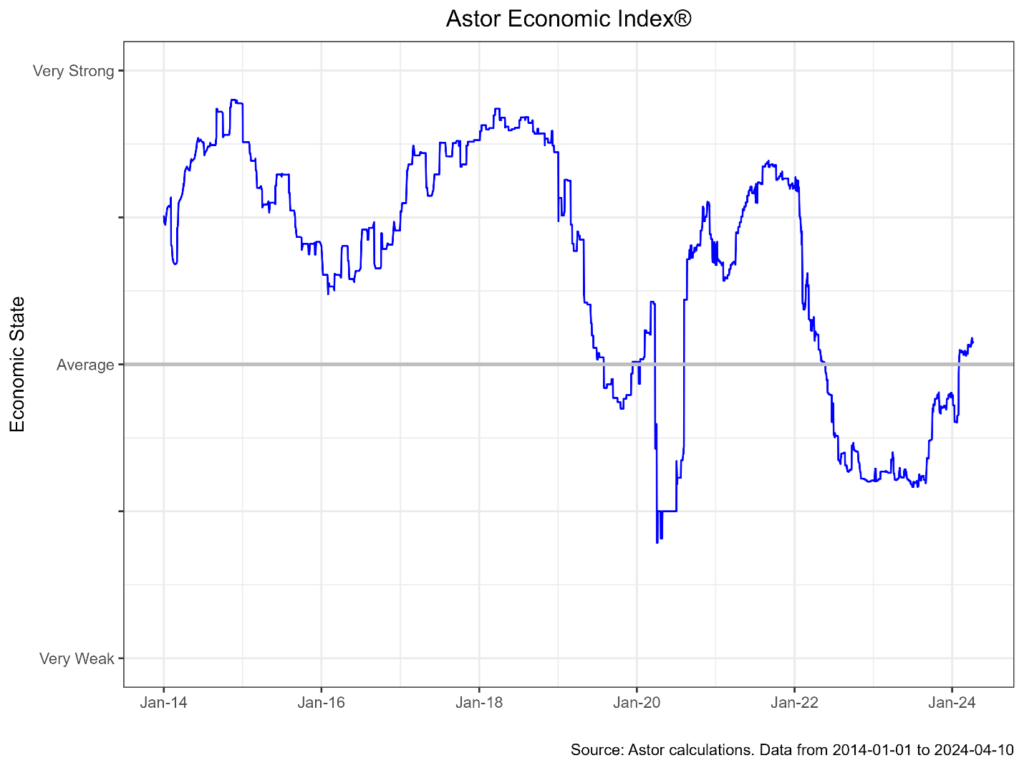

The U.S. economy showed no signs of cooling further, with non-farm payrolls adding a stout 303,000 jobs. Most data point to the labor market being secularly tight. Manufacturing PMIs moved into expansion territory (50.3) for the first time since 2022, although services were a bit weaker. A strong U.S. economy should support international equities, with the U.S. playing its role as the consumer of last resort. Emerging markets should benefit from continued global growth, and we added more exposure to EM equities to Dynamic Allocation accordingly, while retaining an average amount of domestic equities.

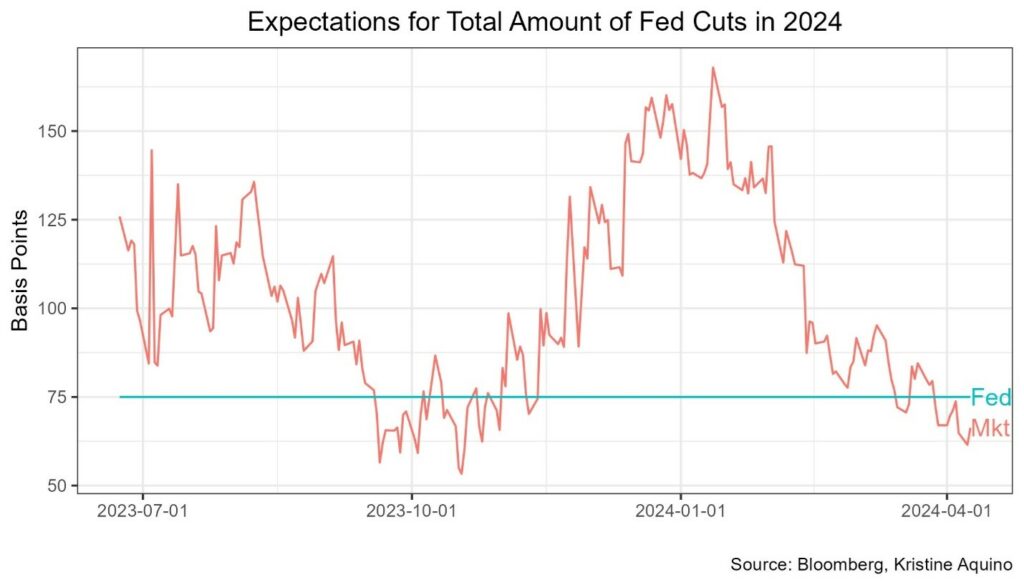

ASTOR ACTIVE INCOME: DIPPING BACK INTO DURATION

The strong economy has led to the market repricing Fed policy in 2024, with average expectations for less easing at 50bps (two cuts). The Consumer Price Index came in well above expectations (0.4% m/m), with “supercore” (excluding housing) up 0.65%. We have been noting for quite some time that market pricing (which reflected as many as 6 cuts for 2024) was unrealistic, given the underlying macroeconomic trends. As a result, our Active Income portfolio had been substantially underweight duration. We now believe that the risk/reward of duration is more evenly balanced, given more realistic expectations for Fed policy, and have begun to add more duration back into portfolios. In Active Income, we swapped a shorter duration position into a longer duration position that provides active exposure to a securitized debt.

In sum, the U.S. economy is showing no real sign of slowing to the extent that Fed officials would like. A recent blog post by the FRBSF highlights the difficulty in eliminating the last-mile of inflation, with most rate sensitive parts of the economy back to normal. A small caveat is that the Fed targets PCE, not CPI, and compositional effects may allow PCE to drift back to normal a bit faster. The Astor Economic Index® sees the U.S. economy as above average, and we will continue to position our portfolios as appropriate for the economy we have, not the economy of wishful thinking.

Astor Investment Management LLC is a registered investment adviser with the SEC. All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. They are not intended as investment recommendations. These materials contain general information and have not been tailored for any specific recipient. There is no assurance that Astor’s investment programs will produce profitable returns or that any account will have similar results. You may lose money. Past results are no guarantee of future results. Please refer to Astor’s Form ADV Part 2A Brochure for additional information regarding fees, risks, and services. The Astor Economic Index®: The Astor Economic Index® is a proprietary index created by Astor Investment Management LLC. It represents an aggregation of various economic data points. The Astor Economic Index® is designed to track the varying levels of growth within the U.S. economy by analyzing current trends against historical data. The Astor Economic Index® is not an investable product. The Astor Economic Index® should not be used as the sole determining factor for your investment decisions. The Index is based on retroactive data points and may be subject to hindsight bias. There is no guarantee the Index will produce the same results in the future. All conclusions are those of Astor and are subject to change. Astor Economic Index® is a registered trademark of Astor Investment Management LLC.

MAS-M-530969-2024-04-17