Sector Allocation

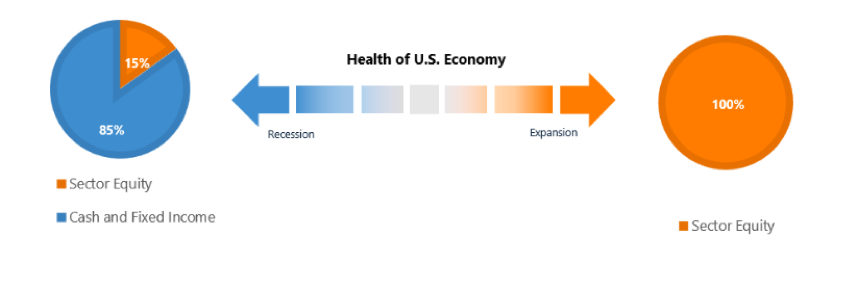

The Astor Sector Allocation strategy is designed to be a core equity allocation within a broader portfolio and seeks to complement other equity investments with its active approach to sector investing. Allocations to specific domestic equity sectors are adjusted based upon Astor’s expectations for growth of the sectors compared to the overall growth of the U.S. economy. During periods of overall economic weakness, the strategy seeks to reduce risk by allocating to cash and fixed income.

Resources

Strategy Highlights

Sector Rotation

Seeks to generate excess returns compared to the broader market by allocating to sectors perceived to have the strongest growth prospects based on the overall health of the general economy.

Managing Risk

Aims to mitigate risk during weak economic periods by allocating away from equity exposure to a mixture of cash and fixed income in an effort to avoid draw downs often associated with poor economic conditions.

Level of Equity Risk

We believe the combination of maneuvering through sectors in various economic cycles and the ability to lower equity allocations provides the portfolio with enhanced risk control. History has shown sharp equity market downturns correlate highly with economic slowdowns and recessions. The Sector Allocation portfolio seeks to identify these disruptions as they occur and adjust allocations accordingly.